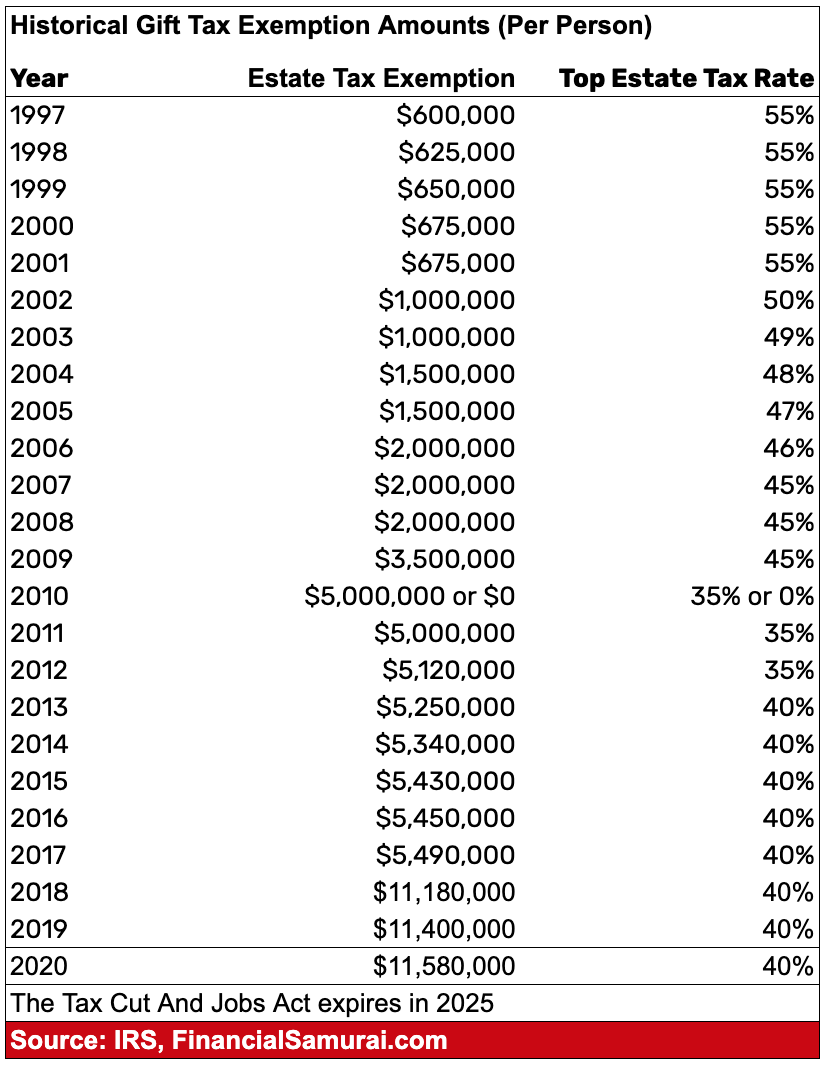

Estate Gift Tax Exemption 2025. We list the ten most important ones for you. 19 rows here we have provided a “cheat sheet” to keep.

Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient (up from. The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayer’s lifetime.

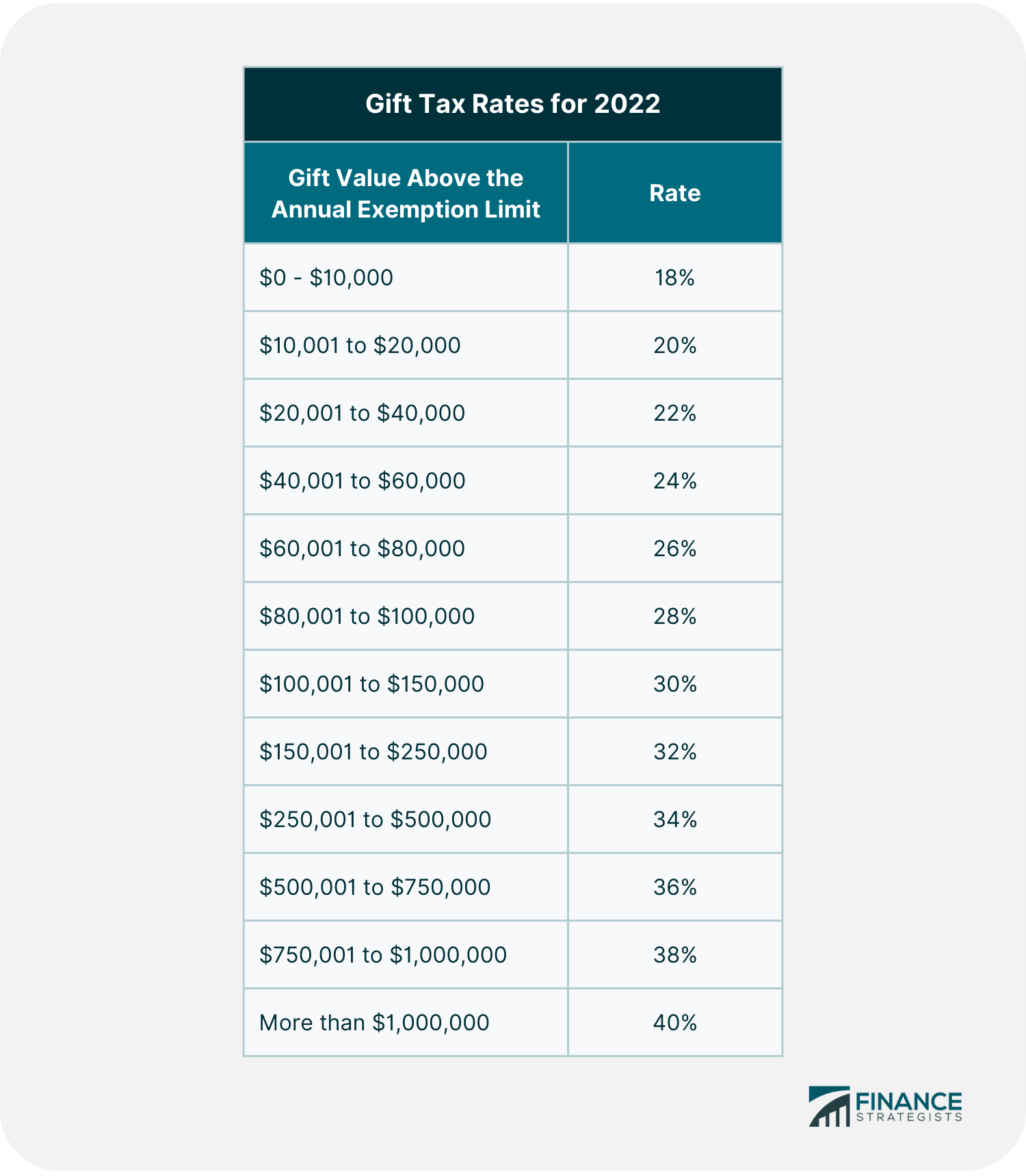

Gift Tax Limit 2025 Exemptions, Gift Tax Rates & Limits Explained, The 2025 annual exclusion amount will be $18,000 (up from $17,000 in 2025).

2025 Estate Tax Exemption Irs Andra Blanche, The lifetime exemption is the amount that individuals can transfer during their lifetime or at death to others without incurring a 40% tax.

Gift Tax 2025 Exclusion Cheri Clemmie, The lifetime exemption is the amount that individuals can transfer during their lifetime or at death to others without incurring a 40% tax.

Lifetime Estate And Gift Tax Exemption 2025 Nancy Valerie, The annual gift tax exclusion will be $18,000 per recipient for 2025.

Lifetime Estate And Gift Tax Exemption 2025 Nancy Valerie, As announced by the irs, the key 2025 federal transfer tax exemption amounts per taxpayer are as follows:

IRS Announces Increased Gift and Estate Tax Exemption Amounts for 2025, The federal estate tax exemption would be reduced from its current level ($13.61 million per individual in 2025) to $3.5 million per.

Virginia Estate Tax Exemption 2025, The exemption from gift and estate taxes is now just above $13.6 million, up from about $12.9 million last year.