Backdoor Roth Ira Contribution Limits 2025. Read the article for more information. The maximum roth ira contribution for 2025.

Your personal roth ira contribution limit, or eligibility to. (these amounts increase to $161,000 and $240,000 respectively for.

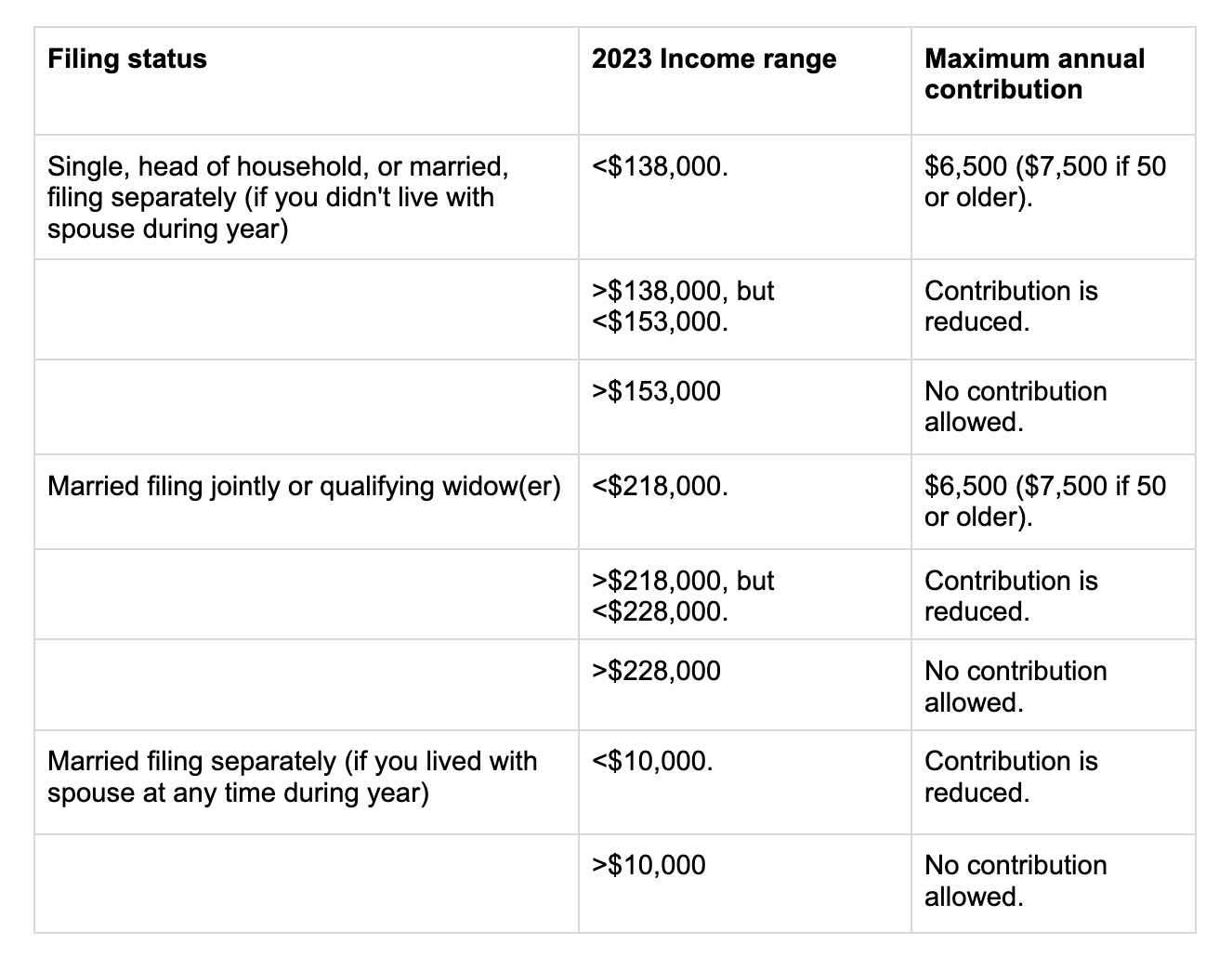

Backdoor roth ira income limits if your modified adjusted gross income (magi) is above certain income limits, then the amount you can contribute to a roth ira is phased out.

The ira contribution limit for 2025 is $6,500 per person, or $7,500 if the account owner is 50 or older.

Roth Ira 2025 Contribution Ailsun Renelle, Roth ira income and contribution limits for 2025. For 2025, the income limit for roth iras is $161,000 for single filers and $240,000 for married individuals filing jointly.

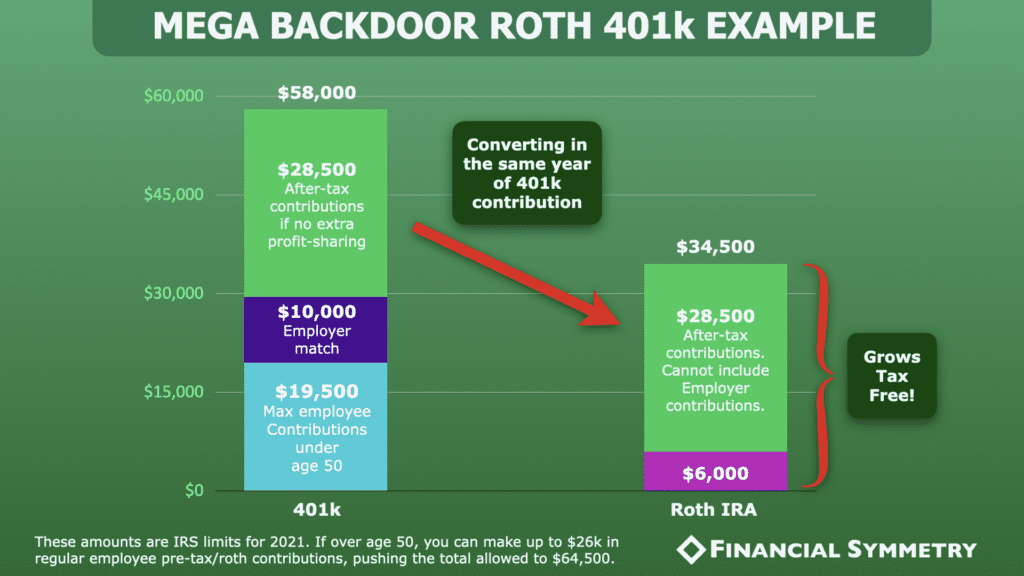

Backdoor Roth Ira Contribution Limits 2025 2025 Terra Rochelle, In 2025, the contribution limit is $23,000 if you’re under 50 and $30,500 if you’re over 50. In 2025, the roth ira contribution limit is.

Roth Ira Limits 2025 Irs, In 2025, the contribution limits rise to $7,000, or $8,000 for those 50 and older. The maximum roth ira contribution for 2025.

Roth Ira Rules 2025 Limits Contribution Bambie Christine, The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or. (these amounts increase to $161,000 and $240,000 respectively for.

2025 Roth Ira Contribution Limits Sybyl Tiertza, The roth ira contribution limits are $7,000, or $8,000 if. For 2025, you can contribute $6,500 yearly (or $7,500 if.

Backdoor Roth Limits 2025 Flora Jewelle, Your personal roth ira contribution limit, or eligibility to. Roth ira income and contribution limits for 2025.

What Are The Roth Ira Contribution Limits For 2025 Sybil Euphemia, But there is one potentially huge possible pitfall to. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or.

Backdoor Roth Limits 2025 Flora Jewelle, Backdoor roth ira contribution limits 2025 2025 terra rochelle, if you have an annual income on the higher end of your category, your contribution limit may be reduced. A backdoor roth ira is a roth ira that is created when those who cannot open roth iras due to income limits convert their traditional iras into a roth ira.

Backdoor Ira Contribution Limits 2025 Judie Marcela, For 2025, the income limit for roth iras is $161,000 for single filers and $240,000 for married individuals filing jointly. [1] if your income is above the limit, a.

Roth Ira Maximum Contribution For 2025 Vs Anica Brandie, For 2025, you can contribute $7,000 yearly. The ira contribution limit for 2025 is $6,500 per person, or $7,500 if the account owner is 50 or older.

A step by step guide that shows you how to successfully complete a backdoor roth ira contribution via vanguard in 2025 (for a mutual fund or brokerage ira).

Find out the roth ira contribution limits for the year 2025, income limits, eligibility, and withdrawal rules.